Farm Insurance California for Beginners

Table of ContentsWhat Does Farm Insurance California Mean?How Farm Insurance California can Save You Time, Stress, and Money.Everything about Farm Insurance CaliforniaFarm Insurance California Fundamentals ExplainedThe 15-Second Trick For Farm Insurance CaliforniaSome Known Details About Farm Insurance California

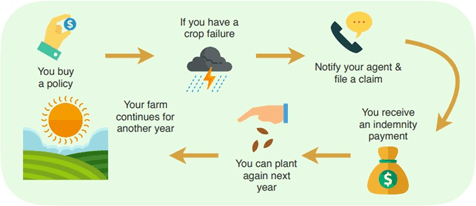

When a plant is harmed by a covered hazard, it is the farmer's responsibility to inform their insurance coverage representative or broker. Do not damage or replant prior to a crop insurance policy insurer has actually checked the damages.Jennifer as well as her household run a 65-cow connection stall dairy farm with a heifer barn and a pregnancy pen. The farm has actually remained in her family for two generations, and they are devoted to taking care of the herd. Jennifer is thinking about increasing her procedure by 10 cows, and also is looking for insurance coverage that will certainly cover greater dollar quantities for plant food, gas, and various other points her farm makes use of routinely.

Jennifer is thinking in advance concerning points such as waste contamination and also various other potential contamination threats. If waste from her livestock contaminates a close-by body of water, Jennifer is legally responsible for the cleanup. She's additionally had a couple of good friends who have had injuries to their pets when they obtain embeded stalls, so she desires to take a look at insurance that guards her ranch versus the costs connected with entrapment.

8 Easy Facts About Farm Insurance California Described

While each plan is special, most farm policies do share some typical terms or attributes. The following is a discussion describing the much more basic components of a farm insurance plan. Understanding the different parts of a plan as well as the concepts of the policy can assist to much better examine a plan to figure out if it supplies sufficient coverage for a farm.

The plan holds the insurer responsible for paying the insured for qualified claims. The contract requires the guaranteed to satisfy specific responsibilities such as the timely reporting of insurance claims. Once the plan comes to be energetic, both the insurance company as well as the insured are legally bound to the terms of the plan.

Fascination About Farm Insurance California

Having all possessions covered under one plan is normally cheaper than having one policy for the ranch possessions and also one more plan for non-farm insurance coverage. Significantly lacking from the above list are vehicles. A different policy might be issued for the coverage of vehicles for both liability and also home loss.

Unique Coverage. Special coverage is the most thorough coverage offered. Unlike fundamental and also broad protection, unique insurance coverage includes whatever other than the identified exemptions. Instead of identifying the hazards covered, special protection uses insurance coverage to every little thing except what is especially identified as an exception. Special protection gives more extensive insurance coverage because whatever is included unless excepted.

Farm Insurance California Things To Know Before You Get This

Unique insurance coverage might include many exceptions. For instance, unique protection will likely consist of an exemption for vandalism in structures that have actually been vacant for 1 month. It is essential to recognize what exemptions are included with special protection. A policy might include several of my site the various kinds of protections.

It is essential to understand what properties are covered under which sort of protection. Unique coverage is best for the most extensive insurance coverage, but specialcoverage is likewise extra expensive than standard and broad insurance coverage. Evaluating the added cost of special protection versus the advantage of thorough coverage offered is a vital analysis to be done for each insurance policy.

Call an representative to learn even more concerning Agribusiness insurance coverage.

Farm Insurance California for Beginners

As each farm is distinct, often tends to be highly tailored, starting at the minimum amount of coverage and obtaining even more personalized depending on the demands of your residence or organization. It is made use of to secure your farm financial investments, as well as not only protects your major farm however likewise your home. If farming is your full-time line of work, farm owner's insurance policy is a smart investment.

Though, this standard insurance policy must be tailored flawlessly to satisfy the demands of your farm. Thankfully, an insurance policy agent will certainly be able to aid you identify what fits your farm! When considering if ranch or ranch insurance is ideal for you, we suggest taking any type of additional browse around this site structures on your land, income-earning animals, as well as any type of employees into factor to consider.

Your farmhouse isn't the only high rate product you possess, as well as due to that, on-site equipment such as tractors, trailers, and others have to be factored in. This rate generally decreases as your equipment depreciates. For a basic ranch and also ranch plan, the ordinary price is established based on your place, procedures, asserts history, as well as extra.

All about Farm Insurance California

Ranch items that have actually been planted are not covered by ranch insurance coverage as well as instead are typically covered by an industrial insurance plan if the amount of sales exceeds your subordinate earnings restriction. Regardless of how lots of precautions you take, accidents can still happen to also one of the most seasoned farmers. If an animal were to escape the ranch as well as trigger a crash, you would certainly look at these guys be accountable for the mishap as you are the animal's owner.

If you are interested in discovering more about farm or cattle ranch protection as well as various other readily available home insurance coverage plans, contact our insurance firm to speak with one of our seasoned insurance agents!.